Table Of Content

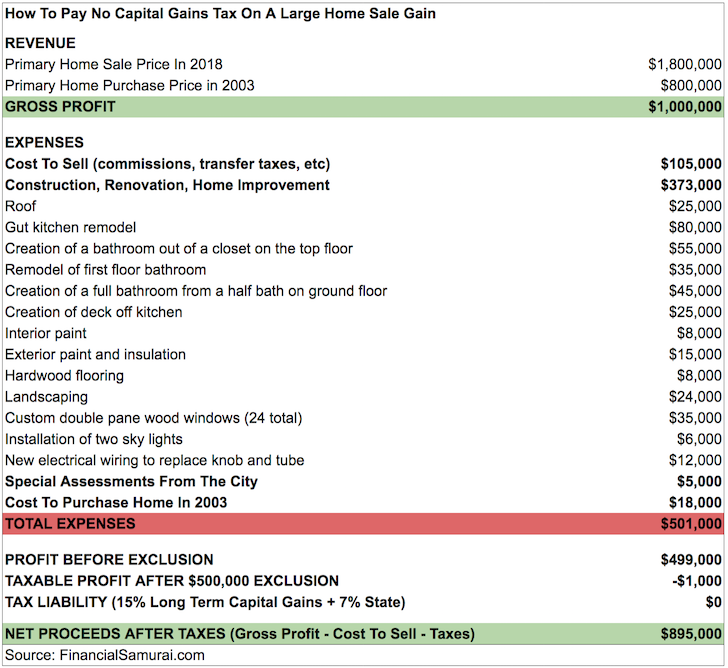

- How to avoid capital gains tax on home sales

- Limit on the deduction and carryover of losses

- You must have lived in the house for at least two years in the five-year period before you sold it

- The Bottom Line: Understanding Capital Gains Taxes On Real Estate Is Important

- Purchase Gift

- Types of Selling Expenses That Can Be Deducted From Home Sale Profit

The rules become more intricate for these additional properties, affecting how much tax you may owe upon their sale. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

How to avoid capital gains tax on home sales

You could owe capital gains tax if you sell a home that has appreciated in value because it is a capital asset. However, thanks to the Taxpayer Relief Act of 1997, most homeowners are exempt from needing to pay it. The change proposed would raise the inclusion rate to 66.67 per cent on capital gains above $250,000 for individuals. That means for the first $250,000 in capital gains, an individual taxpayer would still pay tax on 50 per cent of the asset’s gain but every dollar beyond $250,000 would be two-thirds taxable, Heath said.

Limit on the deduction and carryover of losses

The percentage of the $500,000 or $250,000 gain exclusion that can be taken is equal to the portion of the two-year period that you used the home as a residence. Since executing a 1031 exchange can be a complex process, there are advantages to working with a reputable, full-service 1031 exchange company. Given their scale, these services generally cost less than attorneys who charge by the hour. A firm that has an established track record in working with these transactions can help you avoid costly missteps and ensure that your 1031 exchange meets the requirements of the tax code. The properties subject to the 1031 exchange must be for business or investment purposes, not for personal use.

You must have lived in the house for at least two years in the five-year period before you sold it

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. With this method, you can carry over losses from one tax year into the next, to help offset future gains. Tax loss harvesting only applies if your losses in a given year exceed your total gains. Married couples cannot legally have two primary residences for tax purposes. However, it’s not advisable to rush into selling a property if the intent was to keep it for many years to come, he said.

If you have a net capital gain, a lower tax rate may apply to the gain than the tax rate that applies to your ordinary income. The term "net capital gain" means the amount by which your net long-term capital gain for the year is more than your net short-term capital loss for the year. The term "net long-term capital gain" means long-term capital gains reduced by long-term capital losses including any unused long-term capital loss carried over from previous years. The term “net short-term capital loss” means the excess of short-term capital losses (including any unused short-term capital losses carried over from previous years) over short-term capital gains for the year.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. The 2017 Tax Cuts and Jobs Act created opportunity zones — areas around the country identified as economically disadvantaged.

Ask Nancy: Should I sell my cottage and investment property now instead of next year? - The Globe and Mail

Ask Nancy: Should I sell my cottage and investment property now instead of next year?.

Posted: Fri, 26 Apr 2024 16:52:43 GMT [source]

Purchase Gift

Though the federal capital gains tax is often in the news and subject to political debate, there are also capital gains taxes assessed at the state level. If you live in California, consider working with a financial advisor who can help you plan for these taxes. The policy proposal is much more incremental than revolutionary – aimed, albeit in a small way, at ensuring high earners contribute a fairer portion relative to their massive financial undertakings. Per a 2021 White House release, American billionaires pay an average individual income tax rate of just 8.2%, which might cast them as somewhat less deserving of victim status in the eyes of the average taxpayer.

Under these circumstances, the $50,000 you earned from the sale of the house essentially doubles your income. When you file your federal taxes, the IRS would consider your gross income for that year to be $100,000. After the sale of an investment property, there are two types of tax that you may face.

Angela Rayner: did she commit tax fraud? - The Week

Angela Rayner: did she commit tax fraud?.

Posted: Sun, 07 Apr 2024 07:00:00 GMT [source]

Her articles have been picked up by the Washington Post and other media outlets. Joy has also appeared as a tax expert in newspapers, on television and on radio discussing federal tax developments. The Qualified Opportunity Zone program was created under former President Trump’s 2017 tax reform law the Tax Cuts and Jobs Act (TCJA).

Complicating matters is the Tax Cuts and Jobs Act, which took effect in 2018 and changed the rules somewhat. If you don't meet the eligibility test for the maximum home sale exclusion, you may still qualify for a partial exclusion of gain. For example, according to the IRS, you can meet the requirements for a partial exclusion if the main reason for your home sale was a change in workplace location, a health issue, or an unforeseeable event.

Capital losses incurred in the tax year can be used to offset capital gains from the sale of investment properties. So, although not afforded the capital gains exclusion, there are ways to reduce or eliminate taxes on capital gains for investment properties. Most states tax capital gains according to the same tax rates they use for regular income. So, if you're lucky enough to live somewhere with no state income tax, you won't have to worry about capital gains taxes at the state level. Broadly speaking, capital gains tax is the tax owed on the profit (aka, the capital gain) you make when you sell an investment or asset. It is calculated by subtracting the asset’s original cost or purchase price (the “tax basis”), plus any expenses incurred, from the final sale price.

In the eyes of the IRS, these two forms of income are different and deserve different tax treatment. One strategy to maximize your tax benefits is converting your second home into your primary residence for at least two of the five years preceding the sale. This move can qualify you for a partial exclusion of the capital gains tax, leveraging the aforementioned $250,000 or $500,000 exclusions, depending on your filing status. Net investment income includes capital gains from the sale of investments that haven’t been offset by capital losses—as well as income from dividends and interest, among other sources. For instance, if you have long-term capital losses, they must first be used to offset any long-term capital gains. Any excess losses after that can be used to offset short-term capital gains.

Even if you have no plans to sell soon, try to keep track of money you invest in your home, particularly major remodeling or renovations. Remember to keep organized records and documents, including receipts, bills, invoices and credit card statements, to support your expense claims in case you’re audited. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Keep in mind that there are exceptions for property that’s gifted or inherited.

Your home is not qualified for the exclusion if you purchased it through a like-kind exchange, also sometimes called a 1031 exchange, in the past five years. This kind of purchase basically means swapping one investment property for another. This rule even allows you to convert a rental property into a principal residence because the two-year residency requirement does not need to be fulfilled in consecutive years, just cumulative months. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.

The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. If you have any questions related to the information contained in the translation, refer to the English version. Stepped-up basis is somewhat controversial and might not be around forever. As always, the more valuable your family's estate, the more it pays to consult a professional tax adviser who can work with you on minimizing taxes if that's your goal. For single filers, earnings up to $47,025 are taxed at 0%, with incomes between $47,025 and $518,900 taxed at 15% and above $518,900 at 20%.

Ms Rayner, the Labour deputy leader, has insisted that, while they were together, she lived at a house she owned on Vicarage Road. At base, such tactics obscure the fact that the higher rate is couched in a proposal within a proposal and, even then, would only apply to high earners. Do not include Social Security numbers or any personal or confidential information. This tool will not translate FTB applications, such as MyFTB, or tax forms and other files that are not in HTML format. Some publications and tax form instructions are available in HTML format and can be translated. Visit our Forms and Publications search tool for a list of tax forms, instructions, and publications, and their available formats.

No comments:

Post a Comment